We are committed to lasting social progress. As a reliable partner in the public domain, we strengthen organisations that are building a more social and sustainable Netherlands. Together, we put financial resources to work where they matter most.

Mission

Our mission is to create social impact. Since 1914, we have been working side by side with the public sector in the Netherlands to bring lasting change. Social progress and sustainability and reducing CO2 emissions are central to our work. We see financing as a powerful tool for positive change, supporting a resilient, future-ready society with competitively priced loans and our expertise.

Vision and ambition

We connect with our clients to finance and drive sustainable improvements in the Netherlands. With clear choices and measurable goals, we monitor our progress in the short and long term and attract capital that matches the impact needs of investors.

Strategy

We put cooperation and progress at the heart. As market leader, we support major social transitions for a more social and sustainable Netherlands. Our strategy turns ambition into concrete actions that stimulate both financial and social progress. We connect the capital market and the public sector and act as a knowledge partner for our stakeholders. By collaborating with public partners early stage and structuring the investment agenda together, we find better solutions to finance shared social challenges.

Strategic objectives

We set clear objectives to increase our social impact and provide our customers with optimal support. These seven objectives form the core of our strategy and build on our mission.

We give customers access to the most competitive credit terms by actively managing costs and funding efficiently. We also offer convenient payment services.

We combine digital processes with personal contact to improve accessibility and respond directly to customer needs.

Through our loans and expertise, we help customers make a positive impact on the social and sustainable landscape of the Netherlands.

We streamline our business processes to boost customer satisfaction and maximise social impact.

High-quality, easily accessible data enables us to respond more effectively to changes in the market and among our customers.

Our future-proof IT infrastructure ensures security and reliability for our customers, stakeholders, and employees.

In our inclusive workplace, we nurture diverse talents and perspectives, enabling employees to develop and collaborate effectively.

Actively steering towards social impact

By focusing on five Sustainable Development Goals (SDGs), we continuously enhance our social impact.

- Sustainable cities and communities (SDG 11)

As a partner to housing associations and local authorities, we contribute to the development of affordable and liveable neighbourhoods and public facilities. Good health and well-being (SDG 3)

We promote the accessibility and affordability of healthcare and, as a partner, play a crucial role in making healthcare real estate more sustainable.Quality education (SDG 4)

We support the provision of affordable, high-quality education and help to make educational facilities more sustainable.Affordable and sustainable energy (SDG 7)

Together with partners, we are working to increase the share of renewable energy and improve energy efficiency.Climate action (SDG 13)

We are actively committed to reducing greenhouse gases. With our services, we support initiatives that reduce energy demand and increase energy efficiency.

Stakeholder engagement and value creation model

We maintain a constant dialogue with our stakeholders at various levels to stay informed of current developments and needs. The table below provides an overview of our interactions and engagement with various stakeholder groups.

| Stakeholder | Involvement |

|---|---|

| Clients | We have regular conversations with our clients, where, in addition to financial matters, social impact and sustainability are playing an increasingly prominent role. |

| Shareholders | General Meeting of Shareholders, Extraordinary General Meeting of Shareholders and discussions with ministries, provinces and municipalities. |

| Supervisory Board | The Supervisory Board oversees the activities and policies of the Executive Committee, as well as the way it implements our strategy. An overview of the activities and topics discussed by the Supervisory Board can be found in Chapter 8 of this Annual Report. |

| Employees | We hold a weekly 'Week-Up meeting' where the ExCo or other invitees present relevant matters to all staff. We involve the staff in our Strategy by, among other things, the BNG Boost meeting, which was attended by all employees in 2024. Furthermore, we conduct a pulse survey among the staff twice a year and employees are involved in the bank's direction via the Works Council (OR). |

| Investors | BNG attracts a large part of its funding through public issues (bond issuance) on international capital markets. We have regular discussions with (potential) investors. |

| Supervisory authorities | We consult regularly with the supervisory authorities, including the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Netherlands Authority for the Financial Markets (AFM) on both financial and non-financial issues. |

| Rating agencies | Meetings with a range of rating agencies are held at least once per year. |

| Guarantee funds | Regular consultations take place with the Social Housing Guarantee Fund (WSW) and the Healthcare Sector Guarantee Fund (WfZ) |

| Sector organisations and trade associations | We participate in working groups of the Association of Netherlands Municipalities (VNG) and regularly hold discussions with the association of Dutch housing corporations Aedes and we are involved in the Interprovincial Consultation (IPO). |

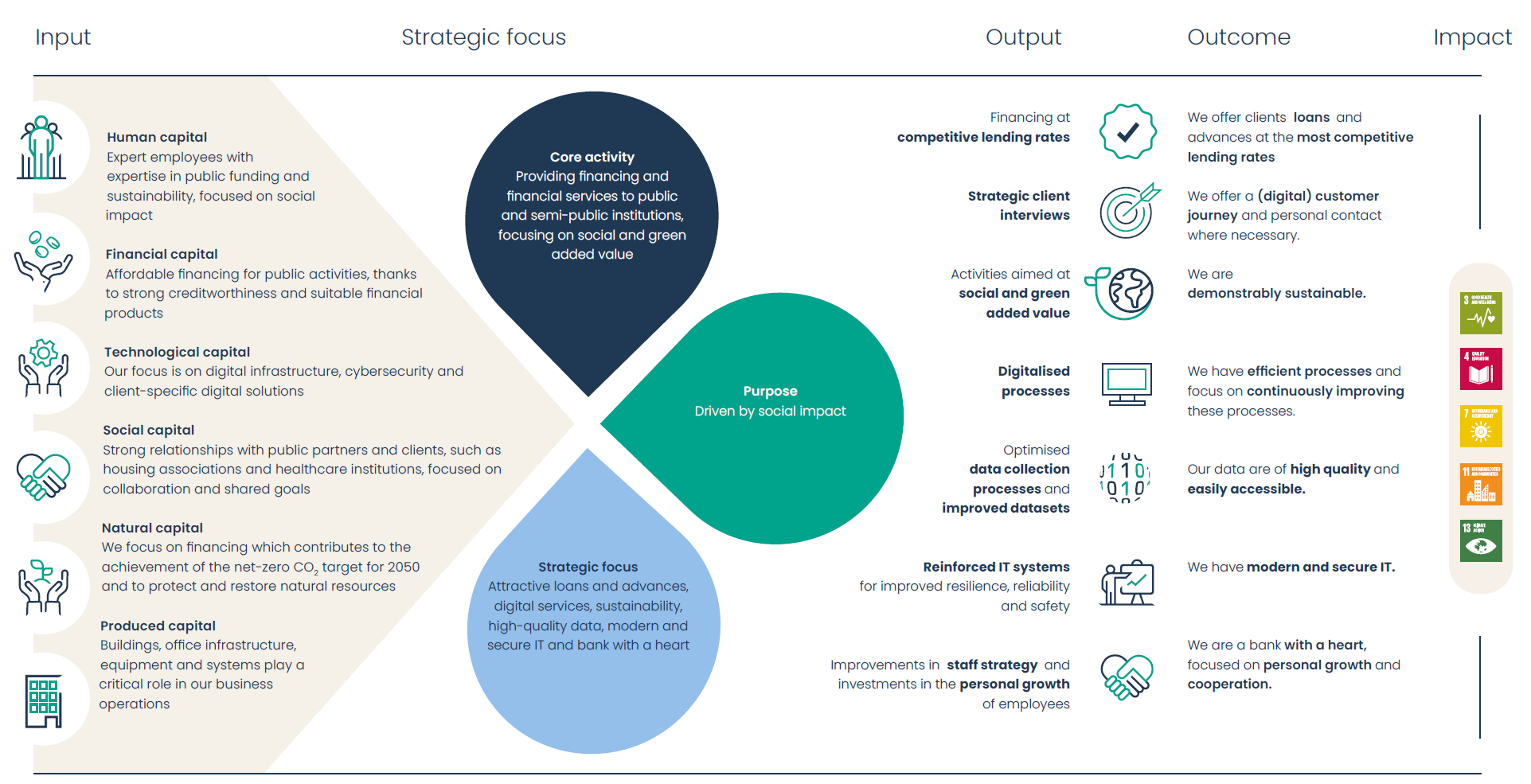

Creating social impact and value together is central to everything we do. In the value creation model below, we apply the six capital model of the International Integrated Reporting Council (IIRC). This model provides insight into the value we add for our stakeholders and society.