Investor relations

BNG is the largest bond issuer in the Dutch public sector after the Dutch state. Half of BNG's capital is held by the Dutch State. The other shareholders are municipalities, provinces and a water authority.

BNG is the largest bond issuer in the Dutch public sector after the Dutch state. Half of BNG's capital is held by the Dutch State. The other shareholders are municipalities, provinces and a water authority.

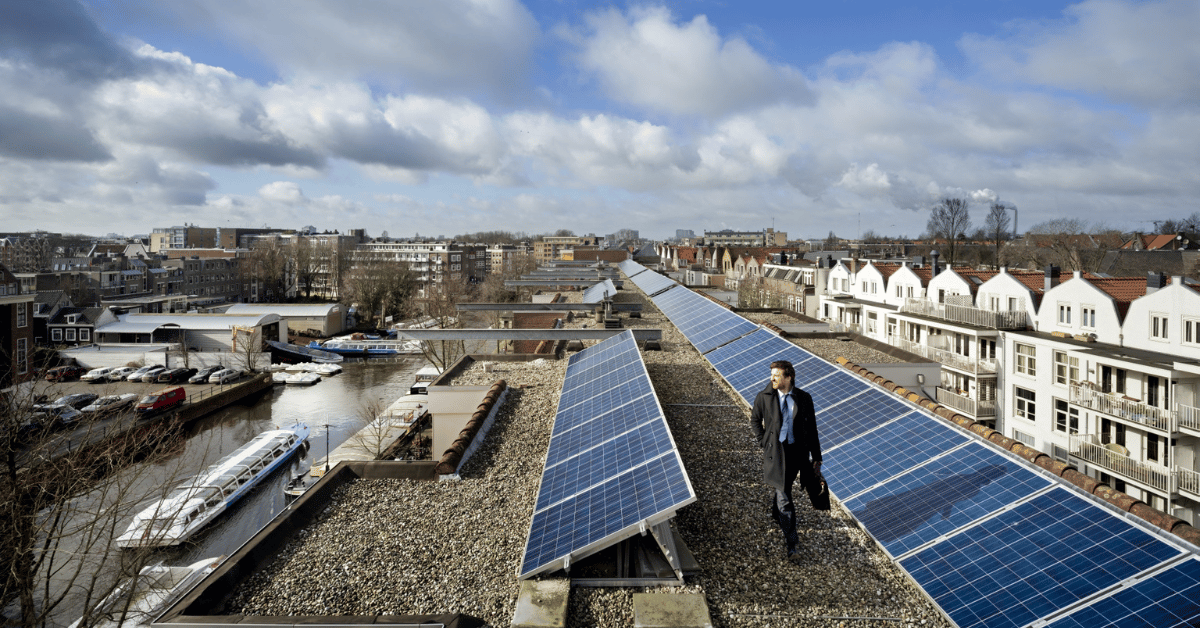

Our public shareholders are long-term stakeholders and support our strategy aimed at creating added value and a lasting social impact. We can achieve this ultimate impact first and foremost by issuing bonds on the capital markets. Thanks to our strong relationship with our investors, our clients are ultimately able to realise important social projects: from sustainable housing to modern hospitals.

Learn more about BNG, our mission, the public sector and economy of the Netherlands, and our financing activities.